The House of Representatives is set to imminently vote on a bill backed by President-elect Trump to avert a government shutdown.

It comes after two days of chaos in Congress as lawmakers fought amongst themselves about a path forward on government spending – a fight joined by Trump and his allies Elon Musk and Vivek Ramaswamy.

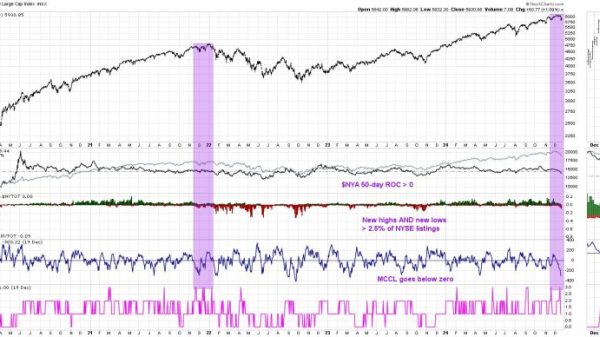

Meanwhile, the national debt has climbed to over $36 trillion, and the national deficit is over $1.8 trillion.

The legislation was hastily negotiated on Thursday after GOP hardliners led by Musk and Ramaswamy rebelled against an initial bipartisan deal that would have extended the government funding deadline until March 14 and included a host of unrelated policy riders.

The new deal also includes several key policies unrelated to keeping the government open, but the 116-page bill is much narrower than its 1,547-page predecessor.

Like the initial bill, the new iteration extended the government funding deadline through March 14 while also suspending the debt limit – something Trump had pushed for.

It proposed to suspend the debt limit for two years until January 2027, still keeping it in Trump’s term but delaying that fight until after the 2026 Congressional midterm elections.

The new proposal also included roughly $110 billion in disaster relief aid for Americans affected by storms Milton and Helene, as well as a measure to cover the cost of rebuilding Baltimore’s Francis Scott Key Bridge, which was hit by a barge earlier this year.

Excluded from the second-round measure is the first pay raise for congressional lawmakers since 2009 and a measure aimed at revitalizing Washington, D.C.’s RFK stadium.

The text of the new bill was also significantly shorter – going from 1,547 pages to just 116.

‘All Republicans, and even the Democrats, should do what is best for our Country, and vote ‘YES’ for this Bill, TONIGHT!’ Trump wrote on Truth Social.

But the bill hit opposition before the legislative text was even released.

Democrats, furious at Johnson for reneging on their original bipartisan deal, chanted ‘Hell no’ in their closed-door conference meeting on Thursday night to debate the bill.

Nearly all House Democrats who left the meeting indicated they were voting against it.

Meanwhile, members of the ultra-conservative House Freedom Caucus also said they would vote against the bill.

‘Old bill: $110BB in deficit spending (unpaid for), $0 increase in the national credit card. New bill: $110BB in deficit spending (unpaid for), $4 TRILLION+ debt ceiling increase with $0 in structural reforms for cuts. Time to read the bill: 1.5 hours. I will vote no,’ Rep. Chip Roy, R-Texas, wrote on X.