Blackstone’s stock is a one-off stock that has gained a boost from the company’s European growth in its private wealth division and its plans to expand to at least two other markets next year. This growth makes it a promising investment avenue for investors.

Blackstone permits the giving of wealth products to customers, which only includes the high-net-worth individuals who are willing to have exposure in private markets with a minimum investment of $10.00-25.00k.

$250B in Wealth Assets and New Funds Ahead

For Blackstone, private wealth assets across the globe increased close to $250 billion, which means a whopping rise of net $103 billion in 2020 and contributing to almost 23% of the total $1.1 trillion assets under management. Both France and Italy rank first among countries in terms of their growth rate. The increase in share in the market in Great Britain is not nearly as critical as it is in other places.

New credit and infrastructure funds, which are going to be emerging in the very early months of 2024, are the future Blackstone pros that, as strategists anticipate, will be improved substantially.

Meanwhile, Blackstone’s friable ‘evergreen’ programs partner with retail investors, allowing them a certain level of freedom to observe the risks of illiquid private assets in relation to the overall supervisory position. However, stakeholders of Blackstone need to be extra careful due to the new norms on withdrawal from their main $55 billion BREIT Fund and thus should stay alert.

In brief, Blackstone stock may be a high-quality investment that can bring long-term value for the company in Europe due to the proper development of wealth products and the European market growing and evolving among individual investors.

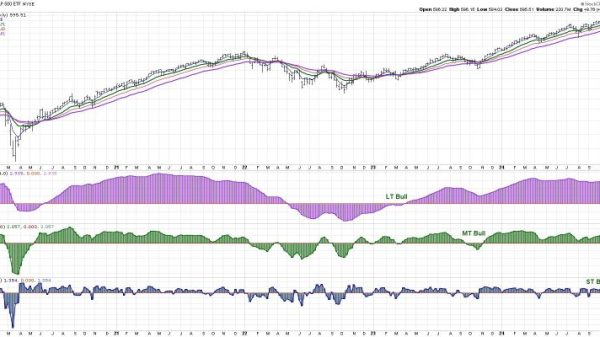

Blackstone Stock Chart Analysis

BX/USD 15-Minute Chart

Blackstone (NYSE: BX) stock is trading at $168.19, which is a minor decline of 0.18% (-$0.30) in the latest trading. The stock has been highly volatile in the past two weeks, with a range that is between $165.05 as the low and $175.92 as the high.

The Relative Strength Index (RSI) on November 4th is 37.48, which is close to oversold (below 30), with the signal line at 44.62. This RSI reading hints that the stock may be heading to a possible support level, though it is not oversold yet.

Price Action Analysis

The candlestick chart shows a series of lower highs and lower lows since the stock was at its recent high of approximately $173 on October 30th. The price movement is currently in a bearish phase in the short term, with resistance levels being at $171-172.

The chart additionally indicates the current buy and sell signals, the buy point at $169.09 and the sell point at $167.50. This means that short-term traders have a small trading range that is available to them.

Although Blackstone is still one of the top companies that deal with alternative asset management, the market’s current price behaviour does not exclude the possibility of out-of-control scenarios. The stock is now beneath both the latest heights and the $170 psychological level, which may be both problems and possibilities for investors.

Considering the technical behaviour and market environment, investors could look for a probable rebound close to the $165-166 support area but should be careful because the RSI is hinting at a further drop in the short term.

“Look into Blackstone’s Increasing Wealth Assets Program – Invest in Long-Term Growth!”

The post Blackstone’s Stock: Wealth Assets Reach $250B appeared first on FinanceBrokerage.