Uranium Royalty (TSX:URC,NASDAQ:UROY) announced the acquisition of an existing royalty on Cameco’s (TSX:CCO,NYSE:CCJ) Millennium and Cree Extension uranium projects in Saskatchewan, Canada.

The company will purchase a net profit interest (NPI) of 10 percent on an approximately 20.6955 percent participating interest in these projects from a third-party industrial gas company for US$6 million.

The Millennium project, located 36 kilometers northwest of Cameco’s Key Lake mill and discovered in 2000, is an advanced-stage uranium asset and one of the largest undeveloped uranium projects globally.

It hosts an indicated resource of 75.9 million pounds of U3O8 at an average grade of 2.39 percent U3O8, as well as an inferred resource of 29 million pounds of U3O8 at an average grade of 3.19 percent U3O8.

The project is a joint venture between Cameco, which holds a 69.9 percent equity share, and Japan Canada Uranium (JCU), which is owned by Uranium Energy (NYSEAMERICAN:UEC) and Denison Mines (TSX:DML,NYSEAMERICAN:DNN).

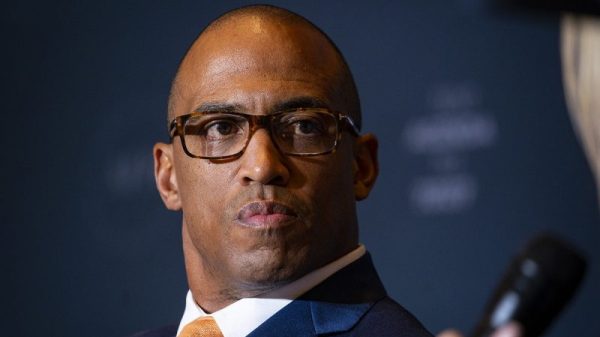

‘Cameco has previously completed substantial development work on the Millennium project and it remains one of the largest undeveloped projects in Cameco’s portfolio,’ said Uranium Royalty CEO Scott Melbye. ‘It represents an important potential contributor to the future global production pipeline. The transaction is another example of our ability to leverage the URC team’s experience and networks to source and execute accretive uranium royalty transactions’

Cameco submitted a draft environmental impact statement (EIS) for Millennium in 2009. The EIS outlined production of 150,000 to 200,000 metric tons of ore per year with a potential mine life of 10 years. However, the company withdrew the EIS application in May 2014 owing to unfavorable uranium market conditions at the time.

No work is planned at Millennium until market conditions signal a need for additional production.

Cree Extension, also near the Key Lake mill, is in the exploration phase. It is a joint venture between Cameco, Orano Canada and JCU, and is west of Denison’s Wheeler River project and southwest of Cameco’s McArthur River project.

The acquired NPI royalty will become payable to Uranium Royalty after the recovery of all qualifying pre-production expenditures incurred after the establishment of the royalty.

The Millennium and Cree Extension projects will provide Uranium Royalty with exposure to approximately 12,800 hectares of ground in the Athabasca Basin, a region known for its high-grade uranium deposits.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.