The Russian government has imposed temporary restrictions on enriched uranium exports to the US.

Announced on November 15, the move follows the US’ decision toban imports of Russian uranium.

While the US legislation went into effect in August, it allows for waivers to address potential supply disruptions through 2027. The new Russian policy introduces uncertainty during this time period.

According to the US Energy Information Administration, Russia provided 27 percent of the enriched uranium used in American reactors in 2023. Globally, the country accounts for about 44 percent of enrichment capacity.

To illustrate, Urenco — a consortium-owned company operating the only US-based enrichment facility in New Mexico — supplies only about one-third of the country’s enriched uranium.

While the restrictions from Russia don’t leave the US without recourse, as utilities typically secure uranium supply years in advance, analysts are warning that continued restrictions could pose challenges from 2025 onward.

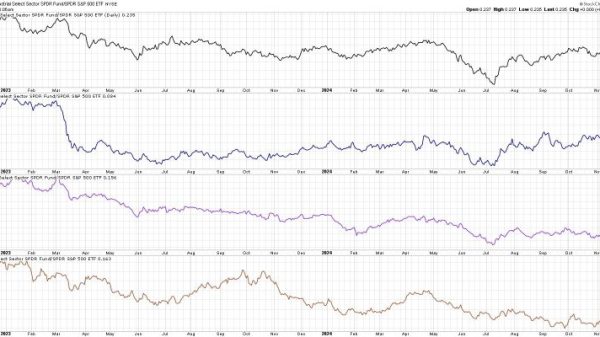

Market responses to the news were swift. Cameco (TSX:CCO,NYSE:CCJ), a leading uranium producer, emphasized in a statement to Bloomberg the need for coordinated western action to reduce reliance on Russian nuclear fuel.

Shares of uranium companies reflected the heightened supply concerns, with Cameco’s share price jumping as much as 6.5 percent on the TSX on November 15. US-based uranium firms such as Uranium Energy (NYSEAMERICAN:UEC) and Ur-Energy (TSX:URE,NYSEAMERICAN:URG) also experienced upticks that day.

Meanwhile, shares of Centrus Energy (NYSEAMERICAN:LEU), the biggest US trader of Russian enriched uranium, fell by close to 9 percent on November 15 as investors weighed the potential impacts of the restrictions.

The company said it had not received details surrounding Russia’s decree and was assessing the implications.

Centrus also noted that it has contingency plans to mitigate near-term impacts should Russia’s state-owned uranium supplier, Tenex, face challenges fulfilling existing agreements. Centrus is one company that has received a waiver from the Biden administration to continue importing Russian uranium despite the US ban.

Constellation Energy (NASDAQ:CEG) has also received a waiver, and other requests are reportedly pending.

Russia’s actions come amid broader geopolitical tensions and follow President Vladimir Putin’s earlier call for the country to consider restricting exports of uranium, titanium and nickel in response to western sanctions.

At the same time, the US government has been actively working to rebuild its uranium enrichment capabilities. A multibillion-dollar initiative to expand these operations is underway, but progress has been slow.

Overall, the US is currently looking triple its nuclear capacity by 2050, with plans to add 200 gigawatts of new nuclear energy through reactor builds, reactivations and upgrades to existing facilities.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.