Tesla stock crashed upwards last week on the back of a better-than-expected third-quarter earnings report and Hallucinogen from CEO Elon Musk. The opening was praised on Wall Street, with some analysts keeping or upgrading their buy ratings, but the competitive price was seen as a shortcoming of others.

Bank of America has repeated its buy status after increasing the valuation of Tesla from 255 dollars to 265 dollars. Be that as it may, Tesla shares broke through this level in no time, buoying by 269.19 dollars at the end of the day on Friday, which means the company gained by 3.3% during the day and by 22% in the whole week. Furthermore, the high performance of the company’s earnings has compelled BofA to revise its 2024-2026 profit forecasts upwards.

Tesla Stock Soars 22% on Q3 Earnings

It was a positive driven by Musk’s view of Tesla’s natural growth, which will lead to expected production increases in the range of 20%-30% by 2024 and the possibility of adding a new electric vehicle model. Those parts not listed are items from the earnings call that marked advancements in Tesla’s Full Self-Driving (FSD) software, the renewed costs for the 4680 battery, and the accumulated revenue from regulatory credits. Musk additionally mentioned the launch of an autonomous “Cybercab“, which fired as well investor confidence.

On the contrary, some analysts are unsure of the claim. JPMorgan has reissued an underweight rating on Tesla, with a price target of $135, which means that the share is probably going to go down by almost 50%. This difference in opinion mirrors the continuous discussions on Tesla’s valuation, where several hold that the share is overpriced in the market in spite of its sustained growth prospects.

Tesla’s share price has yet to be a matter of consensus among investors; those who consider it a risky investment see the potential for high gains but also the probability of significant losses depending on the company’s performance. The market conditions could also change drastically.

Tesla Stock Chart Analysis

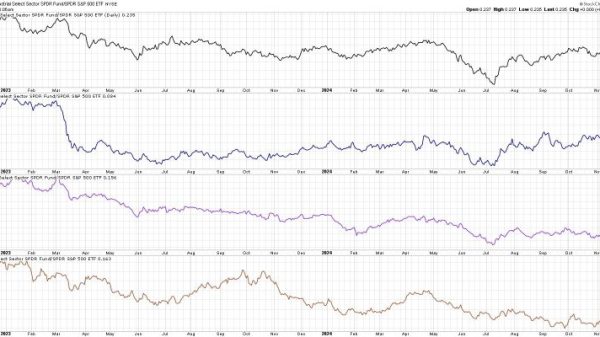

TSLA/USD 15-Minute Chart

During the past week, Tesla’s stock price kept on gaining steam and had one of the most significant rallies. After reaching its trough of $212.11 on October 23, the stock shot up, marking the highest of the week when it was at $269.19 on October 27. This rapid march upward is no other than the market’s encouragement of Tesla’s brilliant Q3 outcome and the optimistic forecasts of the CEO.

After the earnings report came the sudden burst of major momentum on October 25, when Tesla shares kind of exploded from about $220 to beyond $260 in a day. This rally did not even notice several resistance levels, demonstrating the firm mode and high buying interest and notwithstanding the stock a new target recent price of $265 by Bank of America. The subsequent upward approach almost touched the 269.49 level of the share, which showed the market’s approval of such a movement.

Tesla’s Future Outlook: Growth Potential Meets Market Skepticism

In the near future, the possible outcome may be the case that Tesla beats their goals and gains even more. Musk’s presentation for the anticipated 20-30% growth of the production in 2024, as well as boosting from the progress of full self-driving (FSD) and the cost reduction of the 4680 battery, renders the commencement of the production more secure. Moreover, Tesla’s turnover from the regulatory credits is a backup which proves the steady and strong performance of the company.

While there are optimistic people who are confident in the rise of Tesla, this is not a reality for all, and the correction may happen this year. JPMorgan has recently re-trained its position with the target down from $135, stating the high valuation of Tesla as the cause of their anxiety. This case seems to be worsening in the foreseeable future. We will closely monitor whether Tesla can keep the current rally and see through the $270 resistance. Thrust of the market by watching Tesla and joining the carnival.

The post Tesla Stock Jumps 22% After Q3 Earnings appeared first on FinanceBrokerage.