ApeCoin and Akita Inu: New Lows and Support Levels

The price of ApeCoin retreated on Thursday, October 24, to a new weekly low at the 1,110 level The Akita Inu price managed to stabilize above the 0.00000011500 levelApeCoin chart analysis

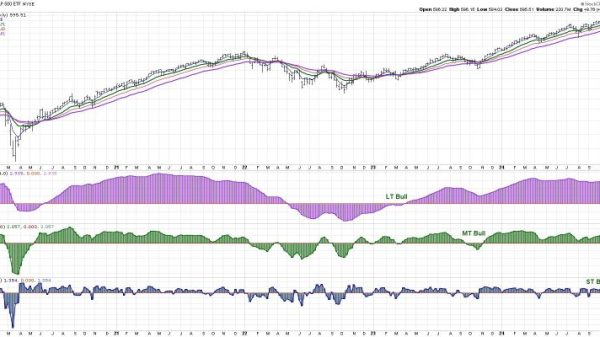

The price of ApeCoin retreated on Thursday, October 24, to a new weekly low at the 1,110 level. We meet the EMA 200 moving average in that zone and get support. After that, the price started a minor recovery to the 1,200 level. There, we lost the bullish momentum again, and now I see that bearish consolidation. ApeCoin is currently at 1,150 and will likely drop to a retest of the EMA 200 moving average.

Potential lower targets are the 1,100 and 1,000 levels. A bullish option requires the price to stop this pullback. After that, we turn to the bullish side. By crossing above the 1,200 level, we will start a bullish momentum. The first possible resistance is at 1,250 and the EMA 50 moving average. This time, we need a break above to continue the bullish option. Potential higher targets are 1,300 and 1,400 levels.

Akita Inu chart analysis

The Akita Inu price managed to stabilize above the 0.00000011500 level. The EMA 200 moving average provides additional support in that zone. Price with shorter bullish impulses hints that it could initiate a recovery to the bullish side. We need a step to 0.00000013000 to test the previous high. We hope for a break above as confirmation of the bullish momentum.

Potential higher targets are 0.00000013500 and 0.00000014000 levels. For a bearish option, the Akita Inu would have to first pull back below the EMA 200 moving average. After that, we expect to test the weekly low at the 0.00000011423 level. The break below confirms the continuation of the bearish side. Potential lower targets are 0.00000011000 and 0.00000010500 levels.

The post ApeCoin and Akita Inu: New Lows and Support Levels appeared first on FinanceBrokerage.